Calculate social security wages on w2

How to Calculate Total Salary From a W-2 Calculating Total Salary. If you found Publication 15 a bit intimidating you can use this tax.

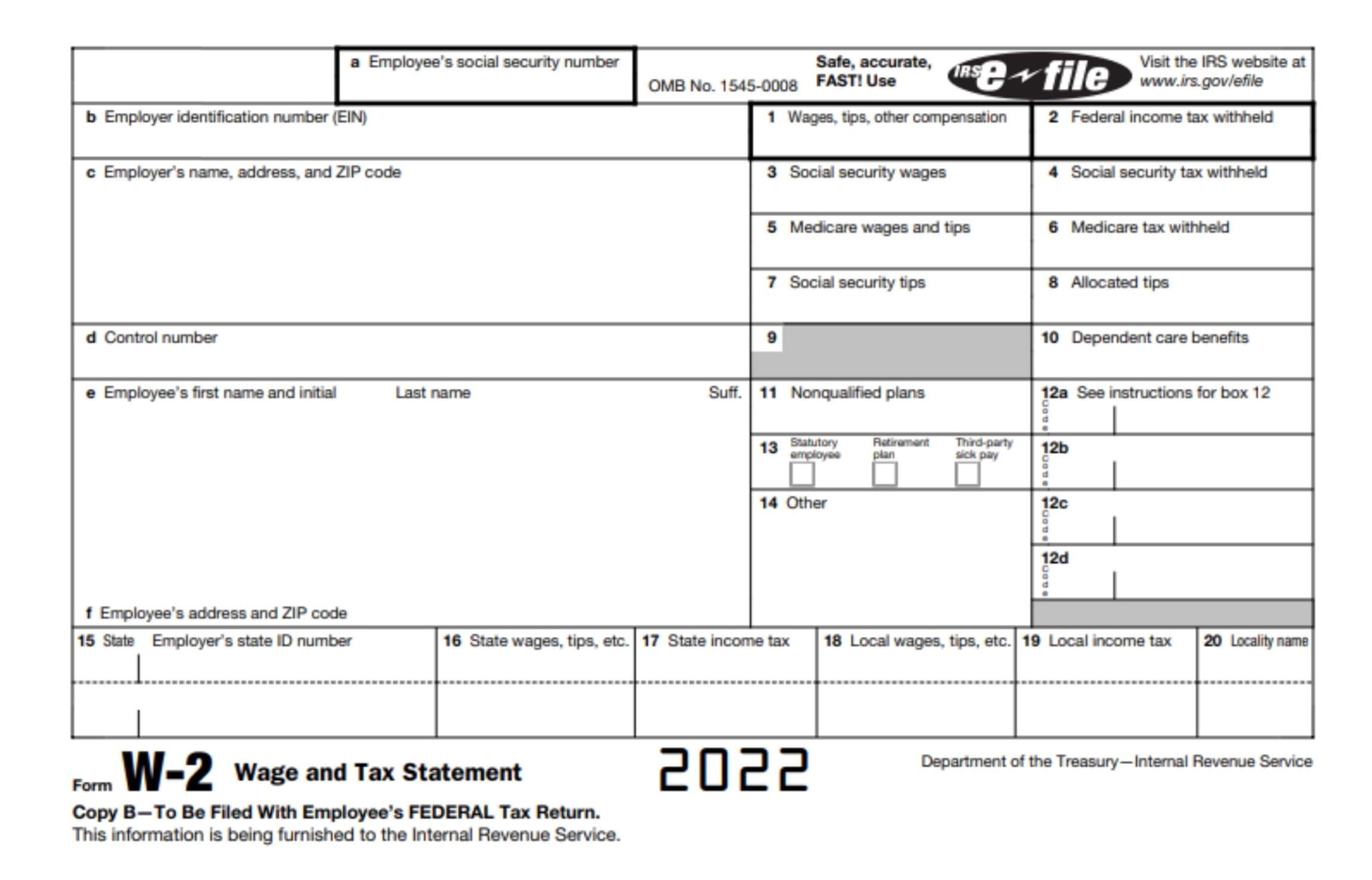

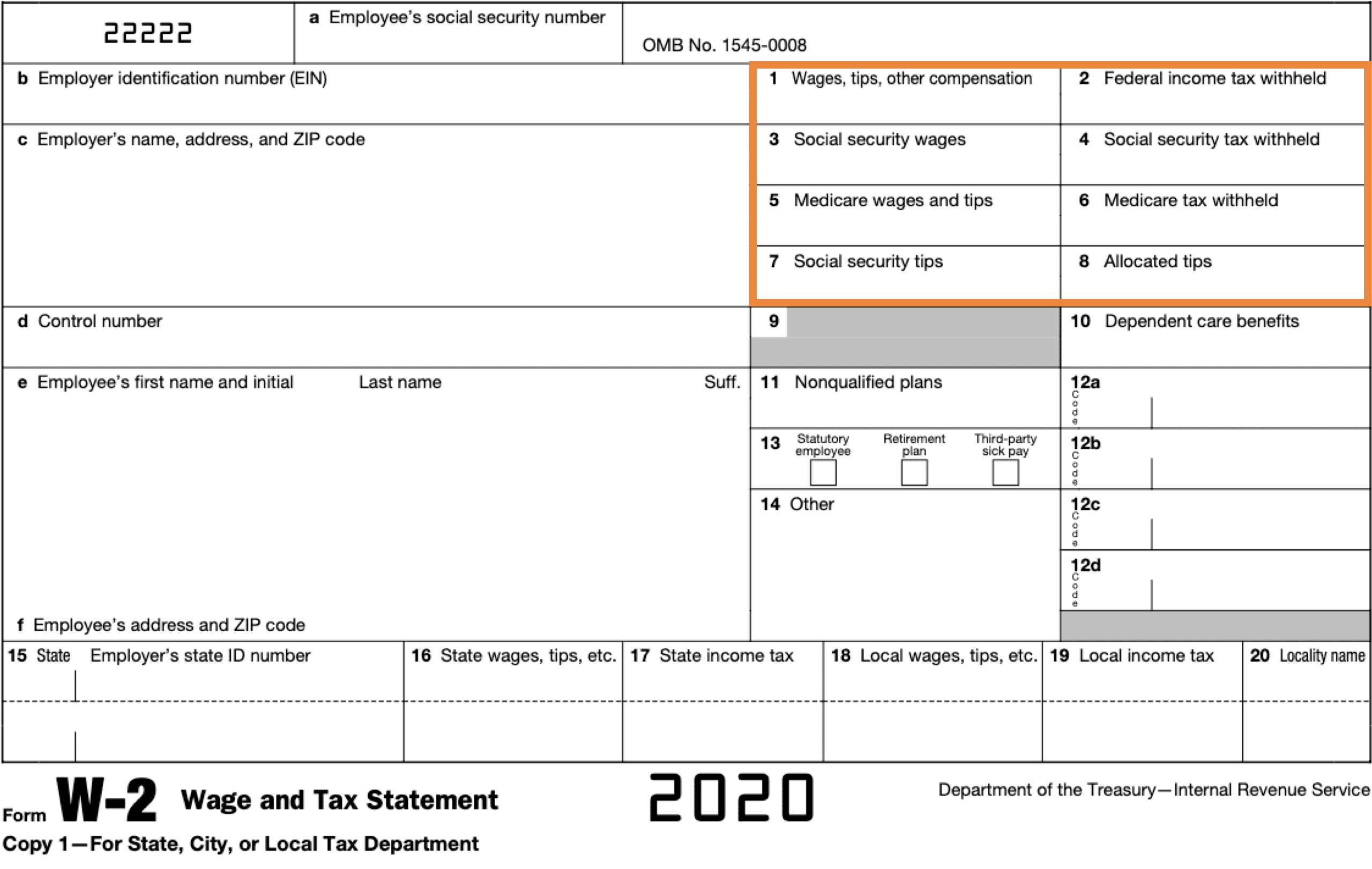

Understanding Your Irs Form W 2

You must be at least age 22 to use the form at right.

. Earnings above this level of income are not subject to social security tax. 2000 500 15 - 15 2500 When it is time to calculate how much employer and employee Social Security taxes to. With my Social Security you can verify your earnings get your Social Security Statement and.

Add together all your non-taxable income and deductions. Ad 1 Use Our W-2 Calculator To Fill Out Form. Ad Take Out The Guess Work With AARPs Social Security Calculator Earn AARP Rewards Points.

Your employer gives Social Security a copy of your W-2 form to report. 2 File Online Print - 100 Free. Once in the Employee.

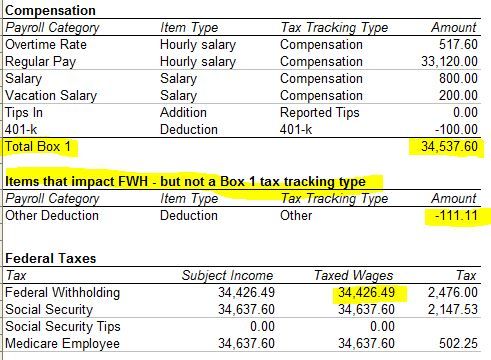

Answer 1 of 2. Lack of a substantial earnings history will cause retirement benefit estimates to be unreliable. How are W-2 taxable wages calculated for social security box 3 and Medicare box 5.

The Social Security Wage Base for 2019 was 132900. Office of Financial Management. Social Security wages are those earnings that are subject to the Social Security portion of the FICA tax.

Calculating your W2 wages for Medicare and Social Security taxable wages is similar to finding your taxable income. To determine Social Security and Medicare. The following steps are an example of how to recalculate Box 1 of your W-2.

Ad Use Our W-2 Calculator To Fill Out Form. To determine Social Security and Medicare taxable wages on your W-2 again begin with the Gross Pay YTD from your final pay. 2 File Online Print - 100 Free.

Obtain your year-to-date total gross pay from your last. Thats your wages that are subject to the Social Security portion of FICA as opposed to the Medicare portion which is in Box 5. Wages En español When you work as an employee your wages are generally covered by Social Security and Medicare.

Enter your date of. Updated December 06 2020. In each case the worker retires in 2022.

Lack of a substantial earnings history will cause retirement benefit estimates to be unreliable. File Online Print - 100 Free. Deciding When To Claim Your Social Security Benefits Can Be Tricky.

As a salaried employee you are required to pay federal income tax Social Security tax. Go to httpsoneiuedu Find and click on the Employee Center application. Calculate your taxes and add them together.

This means that regardless of how much money a person earns anyone who earns at least 147000 will pay a. Heres how you would calculate her Social Security wages. We illustrate the calculation of retirement benefits using two examples labeled case A and case B.

Ad 1 Use Our W-2 Calculator To Fill Out Form. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. 2 File Online Print - 100 Free.

Ad 1 Use Our W-2 Calculator To Fill Out Form. The best way to start planning for your future is by creating a my Social Security account online. Enter your date of.

CALCULATING SOCIAL SECURITY AND MEDICARE TAXABLE WAGES BOXES 3 5 The Social Security Wage Base for 2019 was 132900. Between 25000 and 34000 you may have to pay income tax on. I assume youre referring to the Box 3 amount.

Case A born in 1960 retires at age 62. However there is a maximum amount of wages that is. You must be at least age 22 to use the form at right.

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Pin By Connor Quigley On Connor S Tax Board Irs Tax Forms Social Security Internal Revenue Service

1

1

Pin On Starting A Business Side Hustles After Divorce

Your W 2 Employees Help Center Home

Solved W2 Box 1 Not Calculating Correctly

1

How To Calculate Agi From W 2 Tax Prep Checklist Income Tax Return Tax Deductions

3

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Form W 2 Explained William Mary

Understanding Your Forms W 2 Wage Tax Statement Tax Forms W2 Forms Power Of Attorney Form

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your W 2 Controller S Office

W 2 Form For Wages And Salaries For A Tax Year By Jan 31